Pacific Prime - Truths

Pacific Prime - Truths

Blog Article

Pacific Prime Fundamentals Explained

Table of Contents7 Easy Facts About Pacific Prime ShownRumored Buzz on Pacific PrimeTop Guidelines Of Pacific PrimeThe Main Principles Of Pacific Prime Pacific Prime - The Facts

Your agent is an insurance expert with the understanding to lead you through the insurance policy procedure and aid you find the very best insurance coverage defense for you and the people and things you appreciate most. This short article is for educational and recommendation functions only. If the plan insurance coverage descriptions in this article conflict with the language in the plan, the language in the plan uses.

Insurance holder's fatalities can additionally be backups, particularly when they are thought about to be a wrongful death, as well as property damages and/or damage. Due to the unpredictability of said losses, they are labeled as backups. The insured person or life pays a costs in order to get the benefits promised by the insurer.

Your home insurance policy can aid you cover the damages to your home and afford the cost of restoring or fixings. Occasionally, you can additionally have protection for items or valuables in your residence, which you can then purchase substitutes for with the money the insurance provider gives you. In case of an unfortunate or wrongful fatality of a sole income earner, a household's economic loss can possibly be covered by certain insurance strategies.

Things about Pacific Prime

There are numerous insurance policy plans that include cost savings and/or financial investment plans in enhancement to routine insurance coverage. These can help with building savings and riches for future generations via normal or recurring investments. Insurance coverage can aid your family maintain their criterion of living in case you are not there in the future.

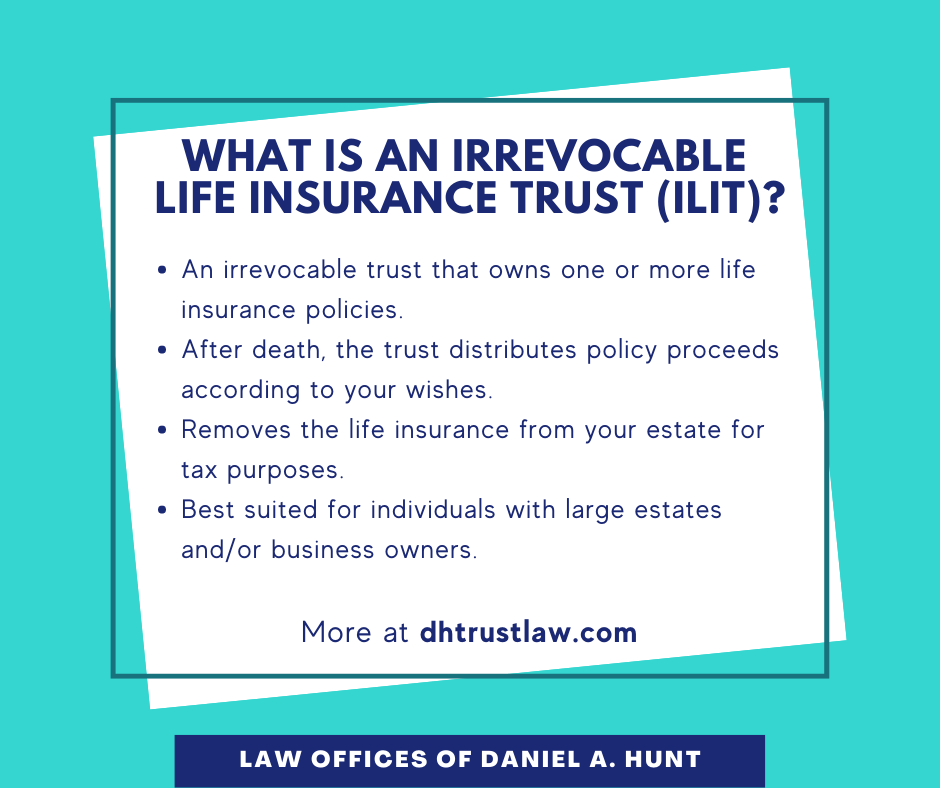

The most standard type for this kind of insurance policy, life insurance coverage, is term insurance coverage. Life insurance policy in basic aids your family become secure economically with a payment amount that is offered in the occasion of your, or the plan owner's, fatality during a details plan period. Child Plans This sort of insurance policy is basically a financial savings tool that aids with producing funds when kids get to specific ages for going after college.

Home Insurance policy This kind of insurance coverage covers home damages in the incidents of accidents, natural catastrophes, and accidents, along with various other similar events. international health insurance. If you are wanting to look for payment for accidents that have actually taken place and you are struggling to figure out the proper course for you, reach out to us at Duffy & Duffy Law Office

Excitement About Pacific Prime

At our regulation firm, we understand that you are experiencing a great deal, and we recognize that if you are concerning us that you have actually been with a whole lot. https://pacificpr1me.weebly.com/. Because of that, we use you a free appointment to review your problems and see exactly how we can best aid you

Since of the COVID pandemic, court systems have actually been closed, which adversely affects car mishap cases in a tremendous means. Again, we are here to help you! We proudly serve the people of Suffolk County and Nassau Region.

An insurance plan is a legal contract between the insurance policy company (the insurance company) and the individual(s), organization, or entity being guaranteed (the insured). Reviewing your plan aids you validate that the policy satisfies your demands which you recognize your and the insurer's duties if a loss takes place. Several insureds acquire a plan without recognizing what is covered, the exemptions that remove protection, and the conditions that should be met in order for coverage to apply when a loss happens.

It determines who is the insured, what risks or residential or commercial property are covered, the policy limitations, and the policy period (i.e. time the policy is in force). The Affirmations Page of a life insurance coverage plan will certainly consist of the name of the individual guaranteed and the face amount of the life insurance coverage policy (e.g.

This is a recap of the significant pledges of the insurance policy firm and mentions what is covered.

4 Simple Techniques For Pacific Prime

Life insurance coverage policies are generally all-risk plans. https://filesharingtalk.com/members/594499-pacificpr1me. The three significant types of Exemptions are: Excluded risks or causes of lossExcluded lossesExcluded propertyTypical instances of omitted perils under a homeowners plan are.

Report this page